The S&P 500 index, a bellwether of the U.S. stock market, comprises companies across diverse sectors. Traders seeking targeted exposure to specific sectors often turn to S&P 500 sector ETFs. These exchange-traded funds track the performance of indices that focus on individual industries. Understanding the trends within these ETFs can provide valuable knowledge for portfolio construction and risk management.

Investigating the returns of different sector ETFs reveals a varied landscape. Factors such as economic conditions, regulatory updates, and technological advancements can significantly impact sector performance.

- Technology ETFs have often exhibited strong performance in recent years, driven by innovation and adoption of new technologies.

- Retail ETFs can be sensitive to economic cycles, as consumer spending patterns are shaped by broader economic conditions.

A diversified portfolio often includes a mix of sector ETFs to manage risk and capture opportunities across different parts of the market. This crucial for investors to conduct thorough research before investing in any ETF, considering their aims, risk tolerance, and time horizon.

Unlocking Returns: Top-Performing S&P 500 Sector ETFs

Navigating the vast landscape of financial instruments can be daunting. For investors seeking to maximize their returns, spreading across solid S&P 500 sectors presents a effective approach. Exchange-Traded Funds (ETFs) offer a flexible vehicle to achieve this diversification, allowing investors to gain exposure to concentrated industry segments within the S&P 500 index.

- Technology : Driving innovation and growth, this sector consistently demonstrates strong performance.

- Healthcare: With an aging population and advancements in pharmaceutical research, this sector presents attractive long-term opportunity.

- E-commerce: Reflecting consumer sentiment and spending trends, this sector can be dynamic.

- Insurance: Providing essential products, this sector tends to influence broader economic conditions.

By carefully analyzing individual ETFs within these sectors, investors can construct a diversified portfolio that aligns with their financial objectives. Remember to perform thorough due diligence and consult with a financial advisor before making any investment decisions.

Leading Sector ETFs for a Well-Rounded S&P 500 Portfolio

Building a well-balanced portfolio within the S&P 500 often involves incorporating sector-specific ETFs. These trading tools allow traders to focus their investments on specific industry sectors, potentially amplify returns and mitigate risk.

Popular sector ETFs to evaluate include those focused on finance. The technology sector has consistently exhibited strong performance, while healthcare and finance offer consistency.

- Examining the latest industry trends and market outlooks can deliver valuable information when identifying suitable sector ETFs for your portfolio.

Asset Distribution: Navigating S&P 500 Sector ETF Investments

When building a balanced portfolio centered around S&P 500 sector ETFs, strategic allocation emerges as a essential Sector ETFs for growth and value stocks component. By allocating capital across diverse sectors, investors can reduce portfolio risk, while potentially capture sector-specific gains. Evaluating the unique characteristics and performance trends of each sector is key for optimizing returns.

- Consider, a portfolio that overweights the technology sector may exhibit greater risk compared to one with a more balanced allocation across sectors.

- Additionally, regularly reviewing portfolio performance against evolving market conditions and investment goals allows for adjustments to ensure optimal weighting.

S&P 500 Sector ETFs: Tailored Strategies for Your Investment Goals

Navigating the dynamic world of investing can be daunting. Investors constantly seek effective ways to optimize their returns and minimize risk. This is where S&P 500 sector ETFs emerge as a valuable tool. These Exchange-Traded Funds provide exposure to specific sectors within the broad U.S. stock market, permitting investors to tailor their portfolios precisely based on their individual objectives.

For instance, an investor with a strong outlook on the innovation sector could deploy a significant portion of their portfolio to a technology-focused S&P 500 sector ETF. Conversely, an investor seeking risk management might choose to spread their investments across multiple sectors {tominimize volatility and potentially enhance overall returns.

- Furthermore, S&P 500 sector ETFs offer visibility as investors can readily understand the structure of each fund. This promotes informed decision-making and allows for strategic portfolio allocation.

- ,Ultimately, S&P 500 sector ETFs provide a versatile mechanism for investors to assemble portfolios that align with their specific investment approaches. By utilizing the advantages of sector-specific exposure, investors can effectively navigate market fluctuations and work towards achieving their financial goals.

Unlocking the Power of S&P 500 Sector ETFs

Investing in the stock market can seem overwhelming, but Exchange-Traded Funds (ETFs) offer a streamlined approach. Among these, S&P 500 Sector ETFs stand out as effective tools for investors seeking to target their exposure on specific industries within the celebrated S&P 500 index. These ETFs track the performance of companies clustered by sector, such as healthcare, allowing investors to leverage trends within their sectors of choice.

By spreading investments across various sectors, investors can minimize overall portfolio risk while seeking for growth. Moreover, sector ETFs often exhibit favorable expense ratios compared to actively managed funds, making them a budget-friendly option for investors.

- Understanding the nuances of different sectors is crucial for making informed investment decisions.

- Regularly monitoring portfolio allocations and adjusting holdings can help to enhance returns over time.

Val Kilmer Then & Now!

Val Kilmer Then & Now! Burke Ramsey Then & Now!

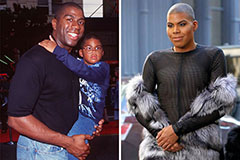

Burke Ramsey Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!